QBO QuickBooks ® FedNow ACH

The Best Solution for FedNow ACH in QuickBooks®

Today Payments is an Authorized Reseller of Intuit offering a highly robust app that supports both QuickBooks’ desktop and online customers, provide merchants with the tools they need so they can focus more time on their customers and businesses, and less time on data entry.

"Our Integrated payment solutions can save a typical small business owner more than 180 hours each year"

See

the features

QuickBooks® ACH, Cards, FedNow and Real-Time Payments

- Payment processing for all QuickBooks desktop, Pro, Premier, Enterprise and also QBO QuickBooks Online Our software is designed for simplicity and ease-of-use.

- ~ Automate Account Receivable Collection

- ~ Automate Account Payable Payments

- ~ One-time and Recurring Debits / Credits

Secure QB Plugin payment processing through QuickBooks ® specializes in the origination of moving money electronically.

Ask about our special:Using FedNow ACH Request for Payments in QBO QuickBooks

Integrating ACH and FedNow for

Account-to-Account (A2A) transfers into QuickBooks Online (QBO)

and QuickBooks can streamline the payment process and enhance cash

flow management for businesses. Here’s how you can achieve this:

Integration Steps

- Select a Payment Processor:

- Choose a payment processor that

supports both ACH and FedNow transactions. Examples

include banks, financial institutions, or third-party

payment gateways like Stripe, Plaid, or Square.

- Connect Your Bank Accounts:

- Ensure your bank accounts are linked

to QuickBooks. This will allow you to manage transactions

directly within the QuickBooks interface.

- In QBO: Go to Banking > Link Account

and follow the prompts to connect your bank account.

- Set Up ACH Payments:

- Use a payment processor that offers

ACH integration with QuickBooks. Some processors provide

built-in support for ACH payments within QuickBooks.

- In QuickBooks Online, you can enable

ACH payments for customer invoices through Sales >

Customers > Edit Customer > Payment and billing.

- Set Up FedNow Payments:

- Since FedNow is a newer service,

ensure your payment processor supports it.

- Integrate FedNow by using the API

provided by the payment processor or financial

institution.

- Work with a developer or your

payment processor to create a custom integration that

connects FedNow’s real-time payment capabilities with your

QuickBooks system.

Integration Points

- Vendor Payments:

- Use ACH for scheduled vendor

payments.

- Use FedNow for instant, real-time

vendor payments when immediate payment is required.

- Customer Invoices:

- Enable ACH payments to allow

customers to pay invoices directly from their bank

accounts.

- Implement FedNow to offer instant

payment options for customers who need to settle invoices

immediately.

- Payroll:

- Use ACH for regular payroll

processing.

- Consider using FedNow for urgent

payroll corrections or for gig economy workers who need

immediate payment.

Differences in Implementation

ACH Integration:

- Transaction Speed: ACH payments

take 1-3 business days to process.

- Batch Processing: Transactions

are processed in batches, which might require scheduling

payments in advance.

- Cost: Typically lower transaction

fees, suitable for recurring payments.

FedNow Integration:

- Real-Time Transactions: Payments

are processed instantly, providing immediate fund

availability.

- 24/7/365 Availability: Payments

can be made anytime, even outside regular banking hours.

- Cost: Potentially higher fees due

to real-time processing, suitable for urgent payments.

Detailed Steps for QuickBooks Integration

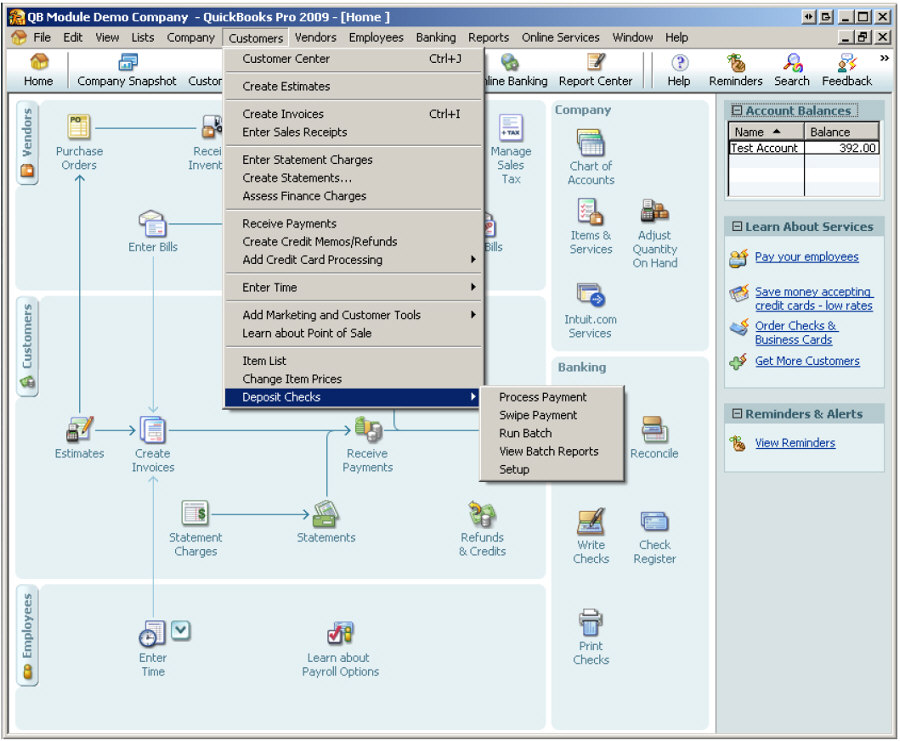

QuickBooks Online (QBO):

- Connect Payment Processor:

- Go to Apps in the left-hand menu.

- Search for your payment processor

app (e.g., Stripe, Plaid).

- Follow the instructions to connect

your payment processor to QBO.

- Enable ACH Payments:

- In Sales, go to Invoices and select

an invoice.

- Click on Receive Payment.

- Select Bank Transfer (ACH) as the

payment method.

- Enable FedNow Payments:

- Custom integrations will likely be

needed. Work with your payment processor to integrate

their FedNow API.

- Set up a webhook or API endpoint to

handle FedNow transactions and update QuickBooks records

in real-time.

QuickBooks Desktop:

- Connect Bank Accounts:

- Go to Banking > Bank Feeds > Set Up

Bank Feed for an Account.

- Follow the prompts to connect your

bank account.

- Set Up ACH Payments:

- Use a third-party ACH service that

integrates with QuickBooks Desktop.

- Follow the service provider’s

instructions to set up ACH payments.

- Set Up FedNow Payments:

- Implement custom integration through

the QuickBooks SDK or a third-party service.

- Work with your payment processor to

ensure real-time payment data is synced with QuickBooks.

Monitoring and Reconciliation

- Transaction Monitoring:

- Regularly monitor ACH and FedNow

transactions within QuickBooks.

- Set up alerts or notifications for

incoming FedNow payments to ensure real-time updates.

- Reconciliation:

- Use QuickBooks’ reconciliation tools

to match transactions with bank statements.

- For FedNow, ensure that the instant

transactions are correctly recorded and reconciled

immediately to maintain accurate cash flow records.

By integrating ACH and FedNow into

QuickBooks, you can streamline payment processing, enhance cash

flow management, and provide flexible payment options to your

customers and vendors.

Integrating ACH and FedNow for Account-to-Account (A2A) transfers into QuickBooks Online (QBO) and QuickBooks can streamline the payment process and enhance cash flow management for businesses. Here’s how you can achieve this:

Integration Steps

- Select a Payment Processor:

- Choose a payment processor that supports both ACH and FedNow transactions. Examples include banks, financial institutions, or third-party payment gateways like Stripe, Plaid, or Square.

- Connect Your Bank Accounts:

- Ensure your bank accounts are linked to QuickBooks. This will allow you to manage transactions directly within the QuickBooks interface.

- In QBO: Go to Banking > Link Account and follow the prompts to connect your bank account.

- Set Up ACH Payments:

- Use a payment processor that offers ACH integration with QuickBooks. Some processors provide built-in support for ACH payments within QuickBooks.

- In QuickBooks Online, you can enable ACH payments for customer invoices through Sales > Customers > Edit Customer > Payment and billing.

- Set Up FedNow Payments:

- Since FedNow is a newer service, ensure your payment processor supports it.

- Integrate FedNow by using the API provided by the payment processor or financial institution.

- Work with a developer or your payment processor to create a custom integration that connects FedNow’s real-time payment capabilities with your QuickBooks system.

Integration Points

- Vendor Payments:

- Use ACH for scheduled vendor payments.

- Use FedNow for instant, real-time vendor payments when immediate payment is required.

- Customer Invoices:

- Enable ACH payments to allow customers to pay invoices directly from their bank accounts.

- Implement FedNow to offer instant payment options for customers who need to settle invoices immediately.

- Payroll:

- Use ACH for regular payroll processing.

- Consider using FedNow for urgent payroll corrections or for gig economy workers who need immediate payment.

Differences in Implementation

ACH Integration:

- Transaction Speed: ACH payments take 1-3 business days to process.

- Batch Processing: Transactions are processed in batches, which might require scheduling payments in advance.

- Cost: Typically lower transaction fees, suitable for recurring payments.

FedNow Integration:

- Real-Time Transactions: Payments are processed instantly, providing immediate fund availability.

- 24/7/365 Availability: Payments can be made anytime, even outside regular banking hours.

- Cost: Potentially higher fees due to real-time processing, suitable for urgent payments.

Detailed Steps for QuickBooks Integration

QuickBooks Online (QBO):

- Connect Payment Processor:

- Go to Apps in the left-hand menu.

- Search for your payment processor app (e.g., Stripe, Plaid).

- Follow the instructions to connect your payment processor to QBO.

- Enable ACH Payments:

- In Sales, go to Invoices and select an invoice.

- Click on Receive Payment.

- Select Bank Transfer (ACH) as the payment method.

- Enable FedNow Payments:

- Custom integrations will likely be needed. Work with your payment processor to integrate their FedNow API.

- Set up a webhook or API endpoint to handle FedNow transactions and update QuickBooks records in real-time.

QuickBooks Desktop:

- Connect Bank Accounts:

- Go to Banking > Bank Feeds > Set Up Bank Feed for an Account.

- Follow the prompts to connect your bank account.

- Set Up ACH Payments:

- Use a third-party ACH service that integrates with QuickBooks Desktop.

- Follow the service provider’s instructions to set up ACH payments.

- Set Up FedNow Payments:

- Implement custom integration through the QuickBooks SDK or a third-party service.

- Work with your payment processor to ensure real-time payment data is synced with QuickBooks.

Monitoring and Reconciliation

- Transaction Monitoring:

- Regularly monitor ACH and FedNow transactions within QuickBooks.

- Set up alerts or notifications for incoming FedNow payments to ensure real-time updates.

- Reconciliation:

- Use QuickBooks’ reconciliation tools to match transactions with bank statements.

- For FedNow, ensure that the instant transactions are correctly recorded and reconciled immediately to maintain accurate cash flow records.

By integrating ACH and FedNow into QuickBooks, you can streamline payment processing, enhance cash flow management, and provide flexible payment options to your customers and vendors.

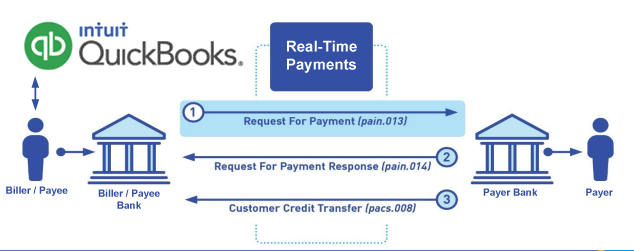

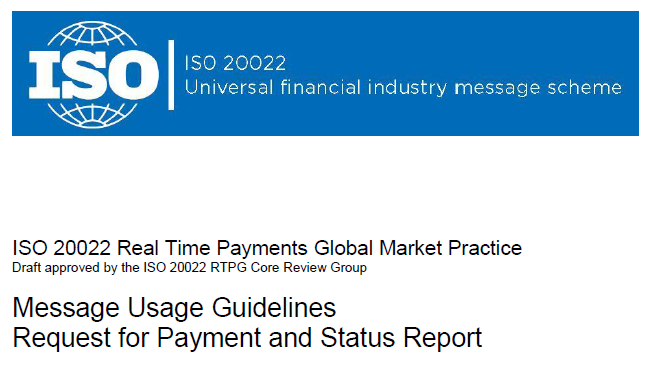

Call us, the .csv and or .xml Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-Time Payments to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) show how to implement Create Real-Time Payments Request for Payment File up front delivering message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continuing through a "Payment Hub", will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

Our in-house QuickBooks payments experts are standing ready to help you make an informed decision to move your company's payment processing forward.

Pricing with our Request For Payment Professionals

1) Free ISO 20022 Request for Payment File Formats, for FedNow and Real-Time Payments (The Clearing House) .pdf for you manually create "Mandatory" (Mandatory data for completed file) fields, start at page 4, with "yellow" highlighting. $0.0 + No Support

2) We create .csv or .xml formatting using your Bank or Credit Union. Using your invoice information database to create an existing Accounts Receivable file, we CLEAN, FORMAT to FEDNOW or Real-Time Payments into CSV or XML. Create Multiple Templates. You can upload or "key data" into our software for File Creation of "Mandatory" general file. Use either the Routing Number and Account Number for your Customers or use "Alias" name via Mobile Cell Phone and / or Email address.

Fees = $57 monthly, including Activation, Support Fees and Batch Fee, Monthly Fee, User Fee. We add your URI for each separate Payer transaction for additional Payment Methods on "Hosted Payment Page" (Request for file with an HTML link per transaction to "Hosted Payment Page" with ancillary payment methods of FedNow, RTP, ACH, Cards and many more!) + $.03 per Transaction + 1% percentage on gross dollar file,

3) Add integrating QuickBooks Online "QBO" using FedNow Real-time Payment using our FedNow ACH system.

Fees Above 2) plus $29 monthly additional QuickBooks Online "QBO" formatting, and "Hosted Payment Page" and WYSIWYG

4) Above 3) plus Create "Total" (over 600 Mandatory, Conditional & Optional fields of all ISO 20022 Pain .013) Price on quote.